Ford, Tesla and GM report gains amid tariffs and other challenges

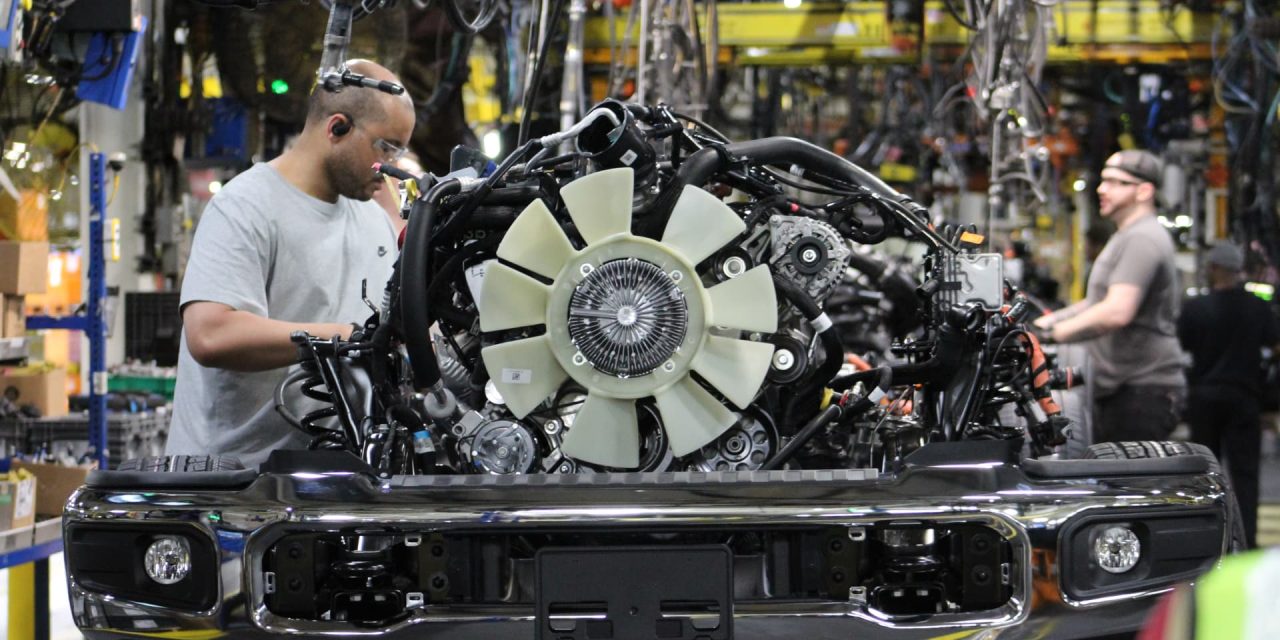

A worker at the Ford truck plant in Kentucky on April 30, 2025.

Michael Wayland | CNBC

DETROIT – “A lot of expense and a lot of chaos.” That’s how it works Ford engine Earlier this year, CEO Jim Farley described the state of the auto industry amid geopolitical tensions, tariffs, inflation and other disruptions.

All of these factors created enormous uncertainty in the US automotive industry, resulting in a relatively pessimistic outlook for the sector in 2025. Some of these concerns have come true, but the industry has proven far more resilient than many expected.

“Six months after the tariffs were imposed, we were pleasantly surprised by the extent to which the industry has held up better than expected,” Barclays analyst Dan Levy said in an investor note last month that upgraded the U.S. auto/mobility sector to “neutral” from “negative.”

Barclays’ neutral rating speaks volumes about the current state of the auto industry, say auto executives, insiders and analysts, who say the circumstances are not as dire as they once feared – but also that they are still not as positive or certain as they could be.

S&P Global released a new report last week outlining how tariff burdens have fallen, but noted that demand headwinds remain due to slowing disposable income growth, consumer pessimism and flexible trade policies. The government shutdown is also unsettling the economic outlook, the company said.

Jim Farley, President and CEO of Ford Motor Company, speaks at a Ford Pro Accelerate event on September 30, 2025 in Detroit, Michigan.

Bill Pugliano | Getty Images

The caution came as S&P revised up its U.S. light-duty vehicle sales estimates by about 2%, to 16.1 million vehicles in 2025 and to 15.3 million, up 200,000, in 2026.

The unexpected optimism is due, among other things, to the fact that industry sales and production performed much better than expected and that general macroeconomic factors such as relatively stable consumer spending were relatively stable.

“The [economic] “The outlook is getting better, and part of that is the realization that tariffs didn’t cause the end of the world, and that’s true in the auto market as well,” Jonathan Smoke, chief economist at Cox Automotive, told CNBC. “I think we’re getting through this and I’m sticking with that optimistic outlook.”

This optimism is put to the test when major automobile manufacturers such as General MotorsFord and Tesla Start reporting third quarter results this week.

According to analyst estimates at LSEG, each of the American automakers is expected to report a double-digit decline in adjusted earnings per share but remain profitable on an adjusted basis.

“We expect to make a profit in the third quarter [are] generally in line with expectations or slightly above expectations. Industrial production actually performed better than expected,” Wolfe Research analyst Emmanuel Rosner said in an Oct. 10 investor note. “But as always, there are nuances to consider.”

balancing act

The automotive industry is in a bit of a balancing act.

Tariffs have cost automakers billions of dollars this year, but deregulation of fuel economy penalties and corporate profits under the Trump administration’s One Big Beautiful Bill Act should help offset those costs, Ford’s Farley and others said.

Meanwhile, there are warning signs of auto lending stress for buyers with lower credit, including the recent bankruptcy of subprime auto lender Tricolor – but new vehicle sales and prices remained far better in the third quarter than many expected.

“There are some positives for next year, but there could also be some really bad negatives if there’s a glitch with tariffs or the consumer finally collapses or something like that,” Morningstar analyst David Whiston told CNBC. “But no one is calling for a complete collapse.”

Fronts of the GMC Sierra Denali, Tesla Cybertruck and Ford F-150 Lightning electric vehicles (from left to right).

Michael Wayland/CNBC

Whiston – who oversees GM, Ford and several auto dealers and suppliers – called his outlook “cautiously optimistic” and said the industry’s significant concerns were offset by other positive circumstances.

UBS analyst Joseph Spak agreed, noting that many challenges for automakers such as tariffs and electric vehicle losses “have already been factored into the 2025/2026 estimates,” he said in an investor note last month.

In addition to economic and political concerns, the auto industry is facing significant changes in the rollout of all-electric vehicles, prompting GM last week to pre-report $1.6 billion in special charges during the quarter related to the decline in electric vehicles.

Adding to this year’s “chaos”, especially for Ford, is a fire last month at aluminum supplier Novelis, which is affecting vehicle production. Wall Street analysts estimate the fire will cost Ford between $500 million and $1 billion in operating revenue.

“The industry is going through a lot of change. It’s facing a number of challenges,” Elaine Buckberg, a senior fellow at Harvard University and former GM chief economist, said of tariffs, electric vehicles and other issues. “The level of volatility they have faced over the last seven years or so is unlike anything before.”

suppliers

The broader supply industry continues to be a major potential problem for automakers, as it did earlier this year.

The auto parts industry is made up of thousands of companies — from publicly traded multibillion-dollar corporations to “mom and pop shops” that make one or two parts — that cannot absorb many, if any, additional cost increases, according to industry experts.

“The market was under pressure. It is fragile,” said Mike Jackson, managing director of strategy and research at the vehicle supplier association MEMA. “Those who are flexible and agile were able to reposition themselves to be successful despite the changes.”

Autolite spark plugs at an auto parts store in Provo, Utah, on Monday, Sept. 29, 2025. First Brands Group Holdings has filed for Chapter 11 bankruptcy, ending weeks of turmoil sparked by creditors’ concerns about auto suppliers’ use of opaque off-balance sheet financing.

George Frey | Bloomberg | Getty Images

Not everyone was able to assert themselves successfully. The bankruptcy of U.S. auto parts maker First Brands Group in late September heightened concerns on Wall Street about the health of the private credit market. First Brands had a network of complex debt arrangements with a variety of lenders and investment funds worldwide.

JPMorgan Chase CEO Jamie Dimon last week called the bankruptcies of First Brands and Tricolor Holdings the “early signs” of excessive corporate lending, while some Wall Street analysts dismissed them as idiosyncratic.

Executives said automakers, also known as OEMs or original equipment manufacturers, have so far done their best to support suppliers when needed and have not passed on the additional tariff costs to such companies, but it is unclear how long that will last.

“Suppliers are clearly working as hard as they can with their customers to mitigate the impact and recognize that it is an important issue that needs to be addressed,” Jackson said. “That said, there were a number of different cost pressures that go beyond tariffs. … That varies by customer and OEM.”

Shares in many larger publicly traded providers such as Aptiv, BorgWarner, Dana And suitablehave increased by double digits so far this year. Even based in Canada Magna InternationalPreviously expected to be one of the hardest-hit companies by tariffs, stocks rose about 7%.

According to MEMA’s latest Vehicle Supplier Barometer, released earlier this month, these gains come despite the third quarter being the 14th consecutive quarter of bearishness among North American automotive supplier executives.

Adding to suppliers’ worries are ongoing tariff issues between the U.S., Mexico and Canada, as well as the Trump administration’s ongoing trade war with China, where many rare earth materials, some of which are used in vehicles, are processed and sourced.

K-shaped concerns

Concerns also remain that the auto industry is an example of a K-shaped economy in the U.S., where the rich continue to see gains while those with lower incomes struggle.

Economists have warned that the U.S. economy is becoming increasingly “K-shaped” in the wake of the coronavirus pandemic, with consumers experiencing different realities depending on their income levels.

Used car dealer CarMax became the first major auto company to raise alarm among consumers late last month.

“The consumer has been worried for some time. I think they’re a little worried,” CarMax CEO Bill Nash told analysts earlier this month. A car loan manager at the used car dealer warned that the “cracks” were “an industry problem”.

But this “problem” appears to only affect lower-income consumers or those with subprime credit, many of whom are not new car buyers.

Wealthier Americans benefited from rising home values, lucrative stock market returns and cheap credit, while low- and middle-income buyers faced tighter budgets and were hit hard by rising inflation.

According to Fitch Ratings, 6.43% of subprime auto loans were at least 60 days delinquent in August, up from the record high of 6.45% reached in January. Default rates for borrowers with higher ratings have remained relatively stable.

“There’s clearly a concern for the consumer because if you’re not at the top of the ‘K’ then there’s stress,” said Cox Automotive’s Smoke. “But it tends to be a demographic story about middle- and lower-income households.”

According to Buckberg, about two-thirds of new car purchases are made by people whose household income is above the median. The U.S. Census Bureau estimates that median U.S. household income was $83,730 last year

This percentage could rise further and impact sales if tariff costs are passed on to new car buyers or the ensuing regulatory chaos takes a greater toll on the automotive industry.

“That’s really the big question for 2026. I think everyone in the industry assumes that auto tariffs will be passed on to consumers. That’s not really the case yet,” Whiston said. “How will the consumer react to this? Will they just take it in stride, pay more and move on? Or will it just lead to massive panic? Nobody knows the answer to that yet.”